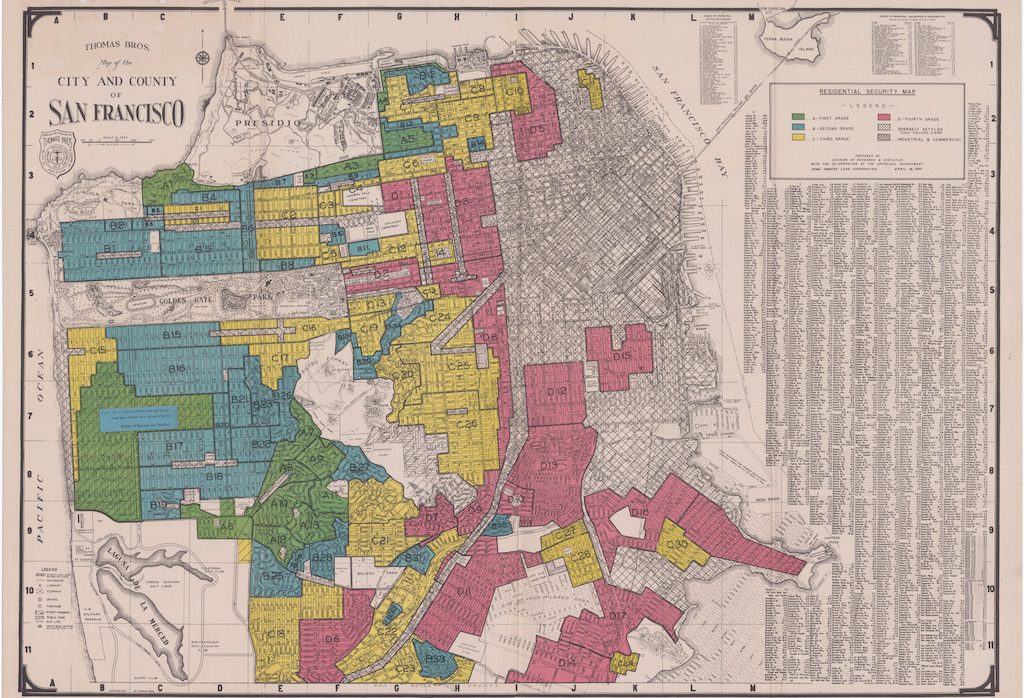

(Mapping Inequality/University of Richmond)

OCC announces final rule to rescind the 2020 rule that would gut the CRA.

On June 5, 2020, the Office of the Comptroller of the Currency issued its new rule gutting the Community Reinvestment Act. This rule decreases investment in low- and moderate-income communities and communities of color — which is contrary to the purpose of the CRA. Former Comptroller of the Currency Joseph Otting made undermining the CRA the hallmark of his tenure as the head of OCC. His overhaul has been roundly criticized by other federal bank regulators, and neither the Federal Reserve nor the Federal Deposit Insurance Corporation (FDIC) — the two other agencies charged with administering the CRA — joined the final rule. One of his final acts as a Trump appointee, Otting immediately resigned after issuing the rule and returned to the private sector.

Amid a pandemic, the ensuing economic downturn, and urgent calls for racial justice, the Trump administration has unlawfully weakened measures meant to protect communities of color from the discriminatory practice of redlining. The CRA was enacted to address redlining and secure access to financial services for communities of color and low- and moderate-income communities — services that have long enabled affluent, white communities to build wealth. Banks are required to meet the financial needs of the communities in which they do business by reinvesting deposits back into that same area, instead of investing the community’s money elsewhere.

OCC’s unlawful new rule:

- Is contrary to the text, history, and purpose of the CRA (and decades of implementation by the three agencies).

- Is almost entirely unsupported by data or analysis and does not account for contrary data and analysis provided by stakeholders, the public, and even other federal agencies.

- Is arbitrary and capricious, as it was finalized without meaningful consideration of the near-universal criticism OCC received from stakeholders.

- Was issued without publication by OCC of the underlying input, data, and analysis that supposedly support it.

- Includes harmful new provisions that were not presented for public comment in OCC’s proposed rule.

These changes were rammed through despite widespread concern voiced by community groups, a coalition of 22 states led by California, and even the banks themselves — which voiced “serious concerns” about the changes.

Furthermore, the OCC kept the public in the dark throughout the rulemaking process as it worked to weaken the CRA’s protections. In violation of the Administrative Procedure Act, the OCC withheld key data and analysis about its decision-making. To make matters worse, OCC publicly criticized and tried to silence groups like NCRC and CRC for their opposition to the proposed changes. It has repeatedly failed to comply with Freedom of Information Act requests submitted by Democracy Forward, NCRC, and CRC, necessitating litigation to compel compliance.

To ensure the OCC follows the law and protects lower- and middle-income communities as the CRA requires, we’ve filed suit on behalf of the National Community Reinvestment Coalition and the California Reinvestment Coalition. Our lawsuit was filed on June 25 with Farella Braun + Martel in the U.S. District Court for the Northern District of California.

Community Reinvestment Groups Sue Trump Administration For Unlawfully Gutting Anti-Redlining Rules

Read the Press ReleaseIn the News

Community groups sue OCC over anti-redlining revamp

25 Jun, 2020

2019 - 2020

We repeatedly called for OCC to release records related to CRA rulemaking.

We had sent 2 FOIA requests and filed 2 lawsuits on behalf of NCRC and CRC to compel the OCC to follow federal transparency laws. OCC failed to release: all data and analysis related to the rollback of the CRA regulations; the unusual steps the agency took to silence CRC and other groups that oppose changes to the CRA; a full accounting of Comptroller Otting’s off-the-record calls with 17 bank executives on gutting the CRA.

Learn MoreMay 21, 2020

We announced our intent to sue the day after OCC announced new CRA rules.

The OCC pressed ahead to force an even more complex and confusing experiment on low- and moderate-income families and communities of color in the middle of the COVID-19 crisis and at a time when the racial wealth gap has been widening.

Learn MoreJune 25, 2020

We filed suit.

We’ve filed suit to ensure OCC follows the law and reconsiders its ill-conceived changes, which OCC’s sister bank agencies recognized were the wrong choice for communities across America.

Learn MoreFebruary 1, 2021

Federal Court Rejects Trump Admin’s Effort to dismiss our lawsuit.

A federal judge rejected the Trump administration’s attempt to dismiss a lawsuit challenging its unlawful June 2020 rollback of essential Community Reinvestment Act (CRA) anti-redlining protections.

Learn MoreMay 2021

OCC announced it would halt further implementation of its 2020 CRA rule to allow for reconsideration of the rule in its entirety.

Portions of the harmful rule that have not yet been implemented, including how banks will be evaluated under new exams and additional data reporting requirements, will not go into effect as originally scheduled. Other provisions that are already in effect, including the designation of activities eligible for credit under the CRA, require further OCC action.

Learn MoreJuly 20,2021

The OCC proposed rescinding the 2020 CRA rule and committed to working with the Federal Reserve and FDIC for a new joint rulemaking.

Amid a pandemic, ongoing economic challenges, and urgent and continued calls for racial justice, today's announcement is a welcome and necessary step forward," said Jeffrey Dubner, Managing Senior Counsel at Democracy Forward. "We will continue our work with the NCRC and CRC to ensure the OCC follows the law and fulfills the purpose of the CRA."

Learn MoreRelated Documents

Skye L. Perryman is President and CEO of Democracy Forward, a nonpartisan, national legal organization that promotes democracy and progress through litigation, regulatory engagement, policy education, and research. Perryman took the helm at Democracy Forward a few months after January 6, 2021, in the midst of rising extremism in communities and courts across the country. She has built a visionary team of legal, policy, and communications experts to confront anti-democratic extremism head-on while also using the law to advance progress and a bold vision for the future. Under Perryman’s leadership, Democracy Forward has expanded the scope and reach of its work, emerging as a nationally recognized institution that is taking on the most significant issues affecting people, families, and communities– from defending civil rights and fair wages to seeking to expand access to reproductive health care post-Dobbs to confronting attacks on education to addressing the climate crisis and much more. Perryman often leverages the power of ordinary Americans, business, industries, and unlikely allies to create impact in this critical time. In 2024, Perryman was named one of the Most Influential People Shaping Policy by Washingtonian magazine, which noted her role as a resource for both moderates and progressives.

Known for her strategic insight and impact-oriented leadership, Perryman has a track record of winning tough legal and policy battles, uniting diverse coalitions, and elevating voices that represent the fabric of our country to deliver results that improve the lives of millions. Over the course of her nearly two decade legal career, Perryman has provided legal and strategic counsel for a broad range of clients and institutions. She previously served as Chief Legal Officer and General Counsel of the American College of Obstetricians and Gynecologists. There, she oversaw legal and policy strategies that resulted in historic advancements in access to health care for women, including developing strategies to support the extension of postpartum Medicaid coverage for more than 500,000 people, overseeing litigation that enabled the distribution of mifepristone by mail for the first time in US history, launching an industry-wide effort to promote racial equity in medicine, and leading comprehensive legal and policy responses to the COVID-19 pandemic. Prior to ACOG, Perryman was a member of the founding litigation team at Democracy Forward, where, in the wake of the 2016 election, she sued to halt the voter suppression activities of the now-disbanded Pence-Kobach voting commission, developed challenges to the politically-motivated rollback of evidence-based program funding, and exposed corruption and wrongdoing through litigation. Perryman has also served in litigation roles at two global law firms where she gained the trust of clients in the health care, financial services, education, and consumer products industries while simultaneously maintaining an active pro bono practice, receiving numerous commendations and awards for her work.

Perryman is a frequent guest lecturer and keynote speaker to national and international audiences on matters at the intersection of law and policy. Her legal work has been cited by the U.S. Supreme Court as well as state supreme courts and her work and perspective are frequently covered by major media outlets such as The New York Times, CNN, MSNBC, NBC, The Washington Post, TIME, Forbes Women, Insider, Ms. Magazine, and Teen Vogue, among many others.

Ms. Perryman grew up in Waco, Texas and is a proud product of K-12 public education. She holds a Bachelor of Arts in Economics and Philosophy magna cum laude from Baylor University where she was elected to Phi Beta Kappa and a Juris Doctor with honors from the Georgetown University Law Center where she served as an Editor for the American Criminal Law Review and was an Editor in Chief for the ACLR’s Annual Survey on White Collar Crime. Skye serves on the boards of the Atlas Performing Arts Center, the Interfaith Alliance, the Baylor Line Foundation, and the Texas Observer.

Armond Baboomian is Chief of Staff and Operations & Deputy General Counsel at Democracy Forward.

Armond comes to Democracy Forward with a deep background in national security. Prior to joining Democracy Forward, Armond worked at the Central Intelligence Agency (CIA) as an analyst and an Assistant General Counsel. Armond earned an LL.M. in National Security Law from Georgetown University Law Center and a J.D. with a concentration in International Law from the University of California Law San Francisco (formerly UC Hastings). Armond attended college at University of California, Berkeley, where he studied Political Science, Rhetoric, and Business Administration.

Armond is a member of the California Bar. Armond enjoys traveling.

Gaby Alvarado is a Senior Digital Strategist at Democracy Forward.

Prior to joining Democracy Forward, she served as a Political Appointee in the Biden-Harris administration, working as a Policy Advisor at the U.S. Office of Personnel Management (OPM). Gaby specializes in uplifting underrepresented and marginalized communities through policy creation, strategic communications, and stakeholder engagement.

Before joining the executive branch, Gaby led multi-million dollar grassroots fundraising campaigns for various progressive organizations. Gaby earned her B.A. in International Relations from American University.

Amahree Archie is the Press Secretary at Democracy Forward.

She and brings years of experience — from the campaign trail to Capitol Hill — managing press, creating messaging that resonates, and telling powerful stories.

Before joining Democracy Forward, Amahree served as Nevada Press Secretary for the Harris for President campaign, where she led media outreach, rapid response, and message strategy in a key battleground state. Previously, Amahree served as Deputy Press Secretary for U.S. Senator Cory Booker, where she helped drive national and local media coverage on a wide range of issues, including reproductive rights and criminal justice reform.

Amahree is passionate about equity, public service, and using communications as a tool to connect people to purpose. She earned her B.A. in Government and African and African Diaspora Studies from The University of Texas at Austin.

Will Bardwell is Senior Counsel at Democracy Forward.

After graduating with honors from the University of Mississippi in 2003, he spent two years as a newspaper reporter at a small, daily newspaper in east Mississippi. In 2008, he returned to the University of Mississippi for law school and graduated with honors.

Will joined Democracy Forward in 2022 after working for six years at the Southern Poverty Law Center, where he developed and litigated cases concerning public education, voting rights, prison conditions, disproportionate sentencing, and other civil rights issues. Before SPLC, Will was in private practice for five years. Will also served as a law clerk at the Mississippi Supreme Court and for Judge Carlton W. Reeves at the U.S. District Court for the Southern District of Mississippi. His experience spans every stage of litigation, and he has litigated in venues ranging from Mississippi justice courts to the United States Supreme Court.

Will is a member of the Mississippi Bar Association, the Magnolia Bar Association, the D.C. Bar Association, and the Federal Bar Association. He is a Green Bay Packers fan and an avid golfer who has contributed to a handful of golf publications, including The Fried Egg and The Golfer’s Journal.

Brooke Bartschat is a Policy and Public Affairs Associate at Democracy Forward.

Prior to joining Democracy Forward, Brooke completed an internship with the National Association of State Alcohol and Drug Abuse Directors, where she assisted in communications and policy work to foster and support the development of effective alcohol and other drug use prevention and treatment programs throughout the country. Brooke received her B.A. in Communications, Legal Institutions, Economics, and Government from American University last fall, and hopes to pursue a J.D. sometime in the future.

Kristin Bateman is Senior Counsel at Democracy Forward.

Before joining Democracy Forward, she was Assistant General Counsel for Litigation at the Consumer Financial Protection Bureau, where she helped lead the team of lawyers responsible for the agency’s defensive, appellate, and amicus litigation. Kristin joined the CFPB just after its founding in 2011 and handled some of the agency’s highest-profile cases, including multiple separation-of-powers challenges to the agency that were ultimately resolved by the Supreme Court. Other work included successfully defending CFPB regulations and enforcement actions in district courts and courts of appeals, beating back constitutional attacks on consumer-protection statutes, and advancing the CFPB’s views on novel statutory interpretation questions.

Kristin clerked for Judge Richard Paez of the U.S. Court of Appeals for the Ninth Circuit and Judge Gary Feess of the U.S. District Court for the Central District of California. Before law school, she worked at People For the American Way promoting voting rights, tax fairness, and civil rights and liberties. She graduated magna cum laude from Harvard Law School and summa cum laude from Georgetown University.

Jacob Bernard is the Deputy Press Secretary at Democracy Forward.

Prior to joining Democracy Forward, Jacob was a Press Assistant to White House Press Secretary Karine Jean-Pierre in the Biden-Harris Administration. In that role, he served as a primary point of contact between members of the White House Press Corps and the Administration. Jacob also brings Capitol Hill and advocacy experience, having worked for Congressman John Larson, Congressman Donald Norcross, and the Human Rights Campaign.

He holds a B.S. in Foreign Service from Georgetown University’s Edmund A. Walsh School of Foreign Service.

Diana Blanco is an Executive Assistant at Democracy Forward.

Prior to joining Democracy Forward, Diana worked as a Banker at Bank of America where she focused on client relationships through proactive outreach, in person meetings to evaluate financial priorities, and providing realistic pathways with the help of partner connections within Bank of America. Diana took great pride in teaching financial literacy in various communities in the Metropolitan area.

Jake Blaut is the Program & Special Projects Coordinator for the Civil Service Strong and Good Government Initiatives at Democracy Forward.

He joins Democracy Forward after serving at the U.S. Department of Education in the Office of Legislation and Congressional Affairs where he facilitated outreach and engagement between Congressional offices and the Department. In that role, he coordinated legislative technical assistance requests and developed research on career, technical, and adult education and higher education issues. Jake has also worked on a variety of political campaigns from the presidential, gubernatorial, senatorial, and congressional levels – including former President Biden’s 2020 primary and general election campaigns.

Jake received his B.S. in Economics and Political Science from Florida State University and is a native of Cincinnati, Ohio.

Pooja Boisture is Senior Counsel at Democracy Forward.

Prior to joining the organization, Pooja was an attorney in the Appellate Section of the Department of Justice, Tax Division, where she represented the United States before federal courts of appeals in cases involving tax and administrative law issues. She briefed and argued high-profile cases on behalf of the government, including cases involving regulatory issues post-Loper Bright. Prior to working in the DOJ, Pooja worked for Debevoise & Plimpton, and, earlier, at Hogan Lovells. She had a diverse private practice, where she worked on commercial litigation, white collar investigations, and appeals. She also maintained an active pro bono practice, focusing on impact litigation. Her pro bono work included leading a class action lawsuit against the New York City Housing Authority on behalf of public housing tenants, and a lawsuit against ICE on behalf of a class of detained immigrants.

Pooja attended Columbia Law School and Boston College. Between college and law school, Pooja worked on reproductive rights at NARAL Pro-Choice New York. She also interned at the New York Civil Liberties Union Reproductive Rights Project after her first year of law school. Pooja clerked for the Honorable Jane Richards Roth on the Third Circuit Court of Appeals. She is an officer and member of the Edward Coke Appellate Inn of Court.

Andrew Bookbinder is a Legal Fellow at Democracy Forward.

Andrew graduated from the University of Pennsylvania Carey Law School in 2024, where he received the Edwin C. Baker award for most pro bono hours in the graduating class. While at Penn Law, Andrew served as the Co-President of the Democracy Law Project, an editor of the Journal of Law and Social Change, an inaugural Penn Law Equity & Inclusion Fellow, and the Public Interest Chair of Penn Law’s Asian Pacific American Law Student Association. Andrew also worked as a Certified Legal Intern with Penn Law’s Advocacy for Racial and Civil Justice Clinic. During his summers, he worked on civil rights issues at the ACLU of Virginia and the Special Litigation Division of the Public Defender Service of D.C.

Prior to law school, Andrew spent two years working as a casework supervisor at the American Red Cross of Los Angeles engaging in housing advocacy and for a year as an intern investigator at the Public Defender Service of D.C., where he supported both the civil and trial divisions. Originally from the D.C. area, Andrew graduated with honors from the College of William & Mary with a B.A. in government.

Steven Bressler is a Senior Legal Advisor at Democracy Forward.

Prior to joining Democracy Forward, he was at the Consumer Financial Protection Bureau, where he most recently served as Deputy General Counsel. At the CFPB he led all appellate, amicus, and defensive litigation work, including, with the Solicitor General, successful defense of the agency’s funding statute in the U.S. Supreme Court, and supervised responses to congressional oversight. He previously served at the DOJ in a variety of roles including Senior Trial Counsel in the Federal Programs Branch, where he litigated dozens of constitutional, administrative, national security, health care, and employment law cases; Chief of Staff in the Office of Legal Policy; and on detail to President Obama’s White House Counsel’s Office. He clerked for the Honorable Norma L. Shapiro on the Eastern District of Pennsylvania and, earlier in his career, was Senior Legislative Assistant to then-U.S. Representative Bernie Sanders.

Bressler holds a J.D., cum laude, from the University of Michigan Law School and a B.A. from Oberlin College.

Dawn Canady is a Senior Litigation Paralegal at Democracy Forward.

Dawn has decades of experience in the legal field, starting in a solo practioner’s rural office. Since receiving a Bachelor’s Degree from the University of Virginia, she has worked at the United States Supreme Court, two international law firms, the Brady Center to Prevent Gun Violence (now Brady United), her local covid call center, and most recently, her local elections office. She has received multiple awards for her dedication and hard work. As a litigation paralegal, senior litigation paralegal, and appellate specialist, she has worked on many types of cases, but the most meaningful to her are the cases promoting justice, democracy, and fairness (civil rights, voting rights, due process, equal protection, marriage equality, campaign finance reform, immigration, and First Amendment cases; especially freeing the wrongfully convicted and detained, limiting the use of the death penalty, and assisting Native American communities). Dawn was also part of the practice management team and at every job has served as a crossover team player, pitching in wherever needed.

Dawn has been in the forefront at all of her workplaces in crafting processes and procedures to increase consistency, communication, and teamwork, and preparing instructional manuals and guides. She is known for her editing skills, attention to detail, and mentoring.

Gloria Chan (she/her) is a Senior Video and Digital Content Strategist.

Gloria is a seasoned and versatile video producer with 15+ years of experience in creating visual content for national advertising campaigns, commercial productions, and progressive movements. She specializes in video strategy that amplifies the voices of underrepresented communities, collaborating with grassroots organizations to help them tell their own stories.

Over the years, she has led video departments at both a boutique commercial production company and a progressive digital strategy firm. Gloria enjoys being hands-on in all aspects of production—from on-set direction to post-production editing.

Maria Fernanda Chanduvi is Senior Communications Manager at Democracy Forward.

Prior to joining Democracy Forward, she worked as a policy fellow for Tech Policy.Press, focusing on technology policy and content moderation research. She contributed to several amicus brief reviews for legal cases before the Supreme Court.

She also served as a Strategic Communications Fellow at Seven Letter LLC, designing and executing communication strategies for various clients across healthcare, clean energy, education, and voting sectors.

Maria Fernanda holds a J.D., specializing in litigation law. She recently graduated from Georgetown University with an M.A. in Communication, Culture, and Technology and aims to explore the intersection of communication, law, and social issues.

Sunu P. Chandy (she/her) is a Senior Advisor with Democracy Forward.

In this role, she advocates for civil rights protections, and works alongside partner organizations, including LGBTQIA+ communities, to help build a nation that does right by all of us. Sunu is also the author of an award-winning collection of poems, My Dear Comrades. Before starting at Democracy Forward in September 2023, she served as the Legal Director of the National Women’s Law Center for six years. She led the Center’s litigation efforts, provided guidance for the Center’s policy positions towards greater workplace justice, and led their LGBTQIA+ rights work. She provided Congressional testimony in support of the Equality Act, a bill that would strengthen and clarify civil rights protections, and provided testimony before the U.S. Commission on Civil Rights on Federal Sector and #metoo. Until August 2017, Sunu served as the Deputy Director for the Civil Rights Division with the U.S. Department of Health and Human Services, and before that, Sunu was the General Counsel of the DC Office of Human Rights (OHR). Previously, Sunu was a federal litigator with the U.S. Employment Opportunity Commission (EEOC) for 15 years. At EEOC, Sunu also led several outreach and training initiatives including as a member of the White House Initiative on Asian Americans and Pacific Islanders (WHIAPPI) Regional Working Group. Sunu began her legal career as a law firm associate representing unions and individual workers in New York City at Gladstein, Reif and Megginniss, LLP. Sunu earned her B.A. in Peace and Global Studies/Women’s Studies from Earlham College in Richmond, Indiana, her law degree from Northeastern University School of Law in Boston, and her MFA in Creative Writing (Poetry) from Queens College/The City University of New York. Sunu serves on the board of directors for the Transgender Law Center, and has been included as one the Washington Blade’s Queer Women of Washington and one of Go Magazine’s 100 Women We Love.

Natasha Chisholm is a Legal Assistant at Democracy Forward.

Prior to joining, Natasha completed an internship at Data for Progress, where she administered national surveys on topics such as abortion and police reform. Natasha received her B.A. in Global Studies, Applied Linguistics, and Russian from Washington University in St. Louis, and hopes to pursue a J.D. in the future.

Katherine Clugg is a Research Assistant at Democracy Forward.

Prior to joining DF, Katherine studied and tracked far right extremism and white supremacy at the Anti-Defamation League’s Center on Extremism and the National Consortium for the Study of Terrorism and Responses to Terrorism (START). She is interested in the mainstreaming of extremist ideologies and the effects on law and policy.

Katherine received a joint B.A. in Criminal Justice and Government and Politics, and a minor in Global Terrorism Studies from the University of Maryland.

Jennifer Fountain Connolly is a Senior Legal Advisor at Democracy Forward.

Jennifer comes to Democracy Forward with over twenty-five years of experience leading some of the nation’s most significant complex litigation. Prior to her arrival, she owned her own legal consulting firm advising government clients on affirmative litigation. Before establishing her firm, she was a shareholder at Baron & Budd, PC where she represented ten states and several large municipalities in cases filed across the country in the opioid litigation. Before that she was a partner at Hagens Berman Sobol Shapiro LLP and managed its Washington DC office, and was a partner at Wexler Wallace LLP. At both those firms Jennifer led national complex litigation including antitrust cases, pharmaceutical and consumer class actions, and whisteblower lawsuits.

Earlier in her career, Jennifer practiced at a Denver-based litigation boutique that is now a part of Sherman & Howard and served as an Assistant Attorney General in the Business Regulation Unit of the Colorado Attorney General’s office where she worked on national and statewide antitrust and consumer protection matters.

Jennifer holds a BA in English from the University of Chicago and a JD from the Sturm College of Law at the University of Denver. In September 2023 she founded Comes Now, a newsletter dedicated to supporting women in the legal profession.

Christine Coogle is Senior Staff Attorney at Democracy Forward.

Christine Coogle previously served as a trial attorney in the Federal Programs Branch of the U.S. Department of Justice Civil Division. In that role, she represented the government in constitutional and statutory challenges in federal district courts nationwide, including on matters related to the Inflation Reduction Act’s Medicare Drug Price Negotiation Program, overtime pay protections for workers under the Fair Labor Standards Act, and statutory removal protections for administrative law judges. Christine received the Attorney General’s Award for Distinguished Service for her work defending the Drug Price Negotiation Program, as well as the Civil Division Rookie of the Year Award and two Civil Division Special Commendation Awards. Prior to her work at DOJ, she clerked on the U.S. Court of Appeals for the Second Circuit and the U.S. District Court for the District of Maryland. Christine first gained experience in high-profile constitutional litigation while still an evening law student, as she spent more than two years working in the Office of General Counsel of the U.S. House of Representatives. She worked on litigation on behalf of the House before the U.S. Supreme Court and federal appellate and district courts, as well as the U.S. Senate sitting as a court of impeachment.

Christine holds a J.D. from the George Washington University Law School with highest honors and a B.A. from the University of Virginia with high distinction.

Julie Couchman is the Director of Marketing & Special Projects at Democracy Forward.

Julie has an extensive background in events, client services and partnerships after 12 years at South By Southwest, a world-renowned conference and festival. She previously worked in Public Relations for a leading political consulting firm and in Marketing for the largest not-for-profit health care system in Texas. An avid traveler, she loves returning home to Texas where she was born and raised. Julie graduated from Texas State in San Marcos and has spent the last 17 years living in Austin.

With a deep love for the arts, she proudly serves as the Special Projects Chair on the board for Women & Their Work, a nonprofit visual and performing arts organization that serves as a catalyst for new ideas in contemporary art created by women through exhibitions, performances, and educational workshops.

Francesca DeLiberis is the Operations Manager at Democracy Forward.

Francesca has a diversified background in office operations for different organizations. Prior to working at Democracy Forward, Francesca has worked as an Office Manager for Rapid Finance. She has also worked in office operations across various organizations including National Geographic Magazine, CBRE, and the Walton Family Foundation.

Francesca has received a B.A. in English from Saint Peter’s University in Jersey City, NJ. She is originally from Vineland N.J., but resides in Maryland currently. She enjoys a good book, and is a bit of a cinephile. She loves to travel to new places, and loves a good trivia night where she can bring out the most random facts she knows

Orlando Economos is a Staff Attorney at Democracy Forward.

His work includes challenges designed to preserve civil rights remedies against attempted diminution, as well as affirmative actions to increase the access of citizens to democracy.

Orlando received his J.D. from Georgetown University Law Center, where he focused on election law and voting rights. He served as legal assistant to Civil Rights Commissioner David Kladney, and later presented oral argument to the D.C. Circuit as a student attorney with the Civil Rights Clinic at Georgetown.

Orlando is native to northern New Jersey. He holds a B.A. in International Relations from Tufts University and a diploma from St. John the Theologian Greek Orthodox Cathedral’s Greek Afternoon School.

Mari Faines is the Manager of External Affairs and Coalitions at Democracy Forward.

Mari joins Democracy forward after serving as an Advisor for Strategy and Communications at the U.S. Department of State. Where she worked in the Office of the AUKUS senior Advisor on strategic communications, diverse stakeholder engagement, and congressional strategy.

Prior to joining the State Department she served as Partner for Mobilization at Global Zero; and Director of Communications and Outreach at Physicians for Social Responsibility. In both roles, she focused on the intersection of nuclear non-proliferation policy and social justice impacts. Prior to these roles, Mari served for five years at TransPerfect, a global solutions firm, where she held Project Manager; Team Lead positions in New York and London respectively.

Mari has written for multiple publications and is a former podcast host. She maintains her foundation in nuclear non-proliferation, conflict resolution, social and transitional justice, and intersectionality through volunteering for multiple advocacy organizations.

She has received honors for her work including being named to the 2022 CSIS/Diversity in National Security Network U.S. National Security & Foreign Affairs Leadership List.

She holds a Master of Science (MSc) in the Politics of Conflict, Rights, and Justice from SOAS University of London, and Bachelor of Arts (BA) in Peace and Conflict Studies & English from Colgate University.

Carrie Flaxman is a Senior Legal Advisor at Democracy Forward.

Carrie joined Democracy Forward after nearly two decades as a litigator and legal advisor for Planned Parenthood Federation of America (PPFA) where she most recently was PPFA’s Senior Director of Public Policy, Litigation, and Law. Over the course of her career, Flaxman has served as lead counsel in a number of trial and appellate matters at the state and federal levels, winning victories that maintained and improved access to reproductive health care services against difficult odds. At Democracy Forward, Flaxman supports the organization in crafting legal strategies to advance the rights of all people and to stop attempts by state and local governmental actors to undermine our democratic values.

Flaxman began her legal career as a clerk for Judge Edward R. Becker of the US Court of Appeals of the Third Circuit, held positions at two national law firms where she handled complex litigation matters, and then joined PPFA. She later served as a consulting attorney for reproductive rights organizations before rejoining PPFA’s national office. Flaxman is a graduate of Yale Law School, where she was executive editor of the Yale Law Journal, and Princeton University, where she graduated Phi Beta Kappa and summa cum laude.

Hannah Flom is the Director of Digital Strategy at Democracy Forward.

Hannah joined Democracy Forward following her time on the Harris-Walz campaign as the Digital Director to Vice Presidential nominee Tim Walz. Previously, she served in the Biden-Harris Administration as a Senior Advisor and Chief Content Officer at the U.S. Department of State, leading creative content and digital communications to advance American diplomacy and educate global audiences on U.S. foreign policy. Hannah has over a decade of experience crafting and executing public affairs campaigns for government and political organizations.

She holds a B.A. in political communication from The George Washington University, and currently resides in Washington, DC.

Prior to joining Democracy Forward, Rachel was a Clinical Fellow and Staff Attorney with the Civil Litigation Clinic at Georgetown University Law Center, where she was lead counsel on APA, FOIA, and other public interest cases. Rachel has argued motions and appeals in state and federal courts, including the United States Court of Appeals for the Second Circuit. Before joining the Clinic, she was an associate at Covington & Burling, LLP, where she practiced insurance litigation and maintained an active pro bono practice.

Rachel clerked for Judge Geoffrey W. Crawford of the United States District Court for the District of Vermont and Judge Robin S. Rosenbaum of the United States Court of Appeals for the Eleventh Circuit. Rachel graduated from Yale Law School, where she was Editor-in-Chief of the Yale Journal of Law & the Humanities.

Rachel is a member of the New York and District of Columbia bars.

Kevin Friedl is a Senior Counsel at Democracy Forward.

Before joining Democracy Forward, he was a senior litigator at the Consumer Financial Protection Bureau, where he handled some of the agency’s highest-profile cases, including two separate constitutional challenges to the agency that were eventually resolved by the Supreme Court. Other work included litigating high-stakes appeals involving novel questions about the CFPB’s authority, defending consumer-protection regulations from industry legal challenges, and helping lead the agency’s amicus program. Kevin represented the CFPB in nearly every stage of litigation, at every level of the federal judiciary, and in courthouses from San Francisco to Boston and from Fargo to McAllen, Texas.

Kevin clerked for Judge David F. Hamilton of the U.S. Court of Appeals for the Seventh Circuit. Before law school, he worked as a journalist in New York and Washington, D.C., primarily covering politics and the economy. He attended New York University School of Law and the University of Chicago.

Shelley Friedland is a Senior Legal Assistant and Legal Support Coordinator at Democracy Forward.

Prior to joining Democracy Forward, Shelley was a paralegal at Harmon, Curran, Spielberg, & Eisenberg, LLP, where she assisted attorneys in incorporating nonprofit organizations and guided nonprofit clients through the federal and state tax exemption application processes.

Shelley received her B.A in Political Science from The George Washington University. She is passionate about the intersection of the law, justice, and nonprofit landscape and hopes to pursue a J.D.

Emily Froude is a research assistant at Democracy Forward. She previously worked as a senior legal assistant. Prior to joining DF, Emily was a senior paralegal at the Amica Center (formerly Capital Area Immigrants’ Rights (CAIR) Coalition). In that role, she screened unaccompanied immigrant children for visas and assisted attorneys in representing the kids in court and with US Citizenship and Immigration Services. Emily holds a bachelor’s degree in international studies and political science from Miami University and a master of international affairs degree with concentrations in democracy studies and international security from George Washington University. She is fluent in Spanish.

Aman George is Senior Counsel at Democracy Forward. His work has included challenges to environmental protection rollbacks, weakening of the Affordable Care Act, and inadequate transparency into the White House’s national security authorities.

Prior to joining Democracy Forward, Aman was a white collar investigations associate at Covington & Burling. His time at Covington also included pro bono work on capital defense and redistricting matters, as well as civil litigation related to insurance, trade, and patent disputes. Prior to law school, Aman was a business analyst at McKinsey & Company for three years.

Aman is a native of northern Virginia, who holds a J.D. cum laude from Harvard Law School and a B.A. in Government and Foreign Affairs and Economics from the University of Virginia.

Aleshadye (El-shuh-dye) Getachew is Senior Counsel at Democracy Forward.

Before joining Democracy Forward, Aleshadye practiced at Children’s Rights in New York, where she investigated and litigated federal class actions on behalf of youth seeking structural reform of state systems. Prior to joining Children’s Rights, Aleshadye litigated complex civil cases and jury trials across the country at Wilkinson Stekloff, a boutique trial firm.

Aleshadye graduated from Georgetown University Law Center cum laude, where she received the Outstanding Student Advocate award for her clinic work on behalf of unhoused communities. She earned her B.S. from Cornell University, and served as a middle school English teacher in Louisiana before going to law school.

Aleshadye is a member of the New York and District of Columbia bars.

Bradley Girard is Senior Counsel at Democracy Forward.

Throughout his career as an impact litigator, Bradley has focused on issues of constitutional law, civil rights, employment discrimination, qualified immunity, and consumer protection, among others. He has practiced in all levels of state and federal courts, with a focus on the federal courts of appeals and U.S. Supreme Court.

After graduating from Georgetown Law, Bradley clerked for the Honorable Neal E. Kravitz on the D.C. Superior Court and on the United States Court of Appeals for the Sixth Circuit for the Honorable Martha Craig Daughtrey. Bradley also served for two years as the clinical teaching fellow at Georgetown Law’s Appellate Courts Immersion Clinic, where he taught students public-interest impact litigation in the federal courts of appeals and the U.S Supreme Court and earned an LLM in advocacy. Bradley was a constitutional litigation fellow at Americans United for Separation of Church and State, where he later returned as Litigation Counsel, litigating cutting-edge First Amendment cases across the country as well as founding and co-directing the Legal Academy. During law school, Bradley worked at Gupta Wessler, Public Justice, Mehri & Skalet, and in the civil-rights division of the Institute for Public Representation. He also interned on the D.C. district court, in the chambers of the Honorable Gladys Kessler.

Bradley served as a 2023-24 Georgetown Law Blume Public Interest Leader in Residence and is serving as a 2024-25 Harvard Law School Wasserstein Fellow. He is on the Advisory Board of the People’s Parity Project. And he is a college and career mentor to students in Baltimore City public high schools.

Bradley’s writing has appeared in a variety of legal publications, including the Georgetown Law Journal, the Georgetown Journal on Poverty Law & Policy, Law360, and SCOTUSblog. He enjoys arguing for hyphenation of phrasal adjectives and against two spaces after a period. Bradley’s non-law interests include woodworking, collecting vinyl (and DJing), crossword puzzles, the cosmos, and jumping off of things into water.

Bradley is a member of the District of Columbia and New York Bars.

Maddy Gitomer is Senior Counsel at Democracy Forward.

Before joining Democracy Forward, Maddy was a member of the Privacy and Cybersecurity practice at Hogan Lovells in Washington, D.C., where she focused on health privacy law, including regulatory counseling. Maddy also maintained a robust pro bono practice focused on protecting reproductive rights, defending against LGBTQ+ discrimination, and expanding access to health care. Earlier in her career, Maddy served as one of Senator Dodd’s professional staff members on the Senate Health, Education, Labor and Pensions Committee’s Subcommittee on Children and Families. There she helped pass the Edward M. Kennedy Serve America Act and served as Chairman Dodd’s lead education policy staff member in the negotiation of The Health Care and Education Reconciliation Act.

Maddy holds a J.D. from The University of Pennsylvania Law School, a master’s degree in education policy from the University of Pennsylvania Graduate School of Education, and a B.A. from American University. While in law school, Maddy received the Edward C. Baker Award for the student with the most pro bono hours in her graduating class and the Penn Law Pro Bono Award for her leadership of the Custody and Support Assistance Clinic. Maddy was also named one of the Best LGBTQ+ Lawyers Under 40 by the National LGBTQ+ Bar Association.

Maddy is a member of the New Jersey, Maryland, and District of Columbia Bars.

Sarah Goetz is Senior Counsel at Democracy Forward.

Prior to joining Democracy Forward, Sarah was a Madison Legal Fellow at Americans United for Separation of Church and State, where she litigated constitutional and other religion-based cases. At Americans United, Sarah authored numerous trial and appellate briefs in federal and state courts across the country. Before that, she was a legal fellow at the American Civil Liberties Union’s National Prison Project, where she litigated settlement enforcement actions concerning conditions of confinement.

Sarah clerked for Magistrate Judge Stephan M. Vidmar of the United States District Court for the District of New Mexico. She graduated summa cum laude from American University Washington College of Law, where she was a Public Interest/Public Service Scholar. During law school, Sarah was a member of law review and a student-attorney in the criminal defense clinic. She graduated with honors from Vassar College, where she earned a B.A. in English.

Sarah is a member of the New York and District of Columbia bars.

Kaitlyn Golden is Senior Counsel at Democracy Forward.

Before joining Democracy Forward, Kaitlyn was a litigator at Hogan Lovells in Washington, D.C., where she handled complex civil matters at all stages of a litigation. For two years, Kaitlyn also served as the full-time senior associate in charge of U.S. Pro Bono, managing the firm’s pro bono practice and litigating gender justice and civil rights matters.

Prior to her legal career, Kaitlyn served as a Press Assistant to U.S. Senator Maria Cantwell and as a Communications Coordinator at the Brooking Institution. Kaitlyn holds a J.D. from Georgetown University Law Center and a B.A. from Ithaca College.

Kaitlyn is a member of the Washington and District of Columbia Bars.

Elena Goldstein is a Legal Director at Democracy Forward.

Elena served most recently as the Deputy Solicitor of Labor in the U.S. Department of Labor (DOL). As the Deputy Solicitor of Labor, Elena helped to lead DOL’s 650-person legal office, overseeing numerous litigation, regulatory, and policy matters relating to the rights of workers, job-seekers, and retirees in the United States.

Immediately prior to serving as the Deputy Solicitor of Labor, Goldstein served as Deputy Chief of the Civil Rights Bureau in the New York State Office of the Attorney General, where she was a lead counsel in numerous cases challenging federal executive and agency actions in the forty-fifth Presidential administration and supervised a wide range of civil rights matters.

Elena’s career also includes nine years as a senior trial attorney in DOL’s Office of the Solicitor, litigating cases involving minimum wage and overtime laws, workplace safety, whistle-blower statutes, and a variety of other labor and employment laws. Earlier in her career, she worked as a Skadden Fellow and senior staff attorney at the New York Legal Assistance Group, where she helped to start a workers’ rights project focusing on the rights of low-wage and immigrant workers, and as third grade teacher at Public School 152 in New York City.

Elena served as a law clerk for the Honorable Jed S. Rakoff in the Southern District of New York and the Honorable Robert A. Katzmann on the Second Circuit Court of Appeals. She graduated summa cum laude from the University of Michigan and is a magna cum laude graduate of Harvard Law School. Elena is currently licensed to practice in New York. Her license in Washington D.C. is pending.

David Graham-Caso is the Associate Director of Communications for Democracy Forward.

David joins Democracy Forward after having been on the forefront of some exciting and important recent progressive efforts. He led the Sierra Club’s communications work in the Western US to stop new coal-fired power plants from being permitted and to replace those still running with clean energy; he served as the point-person for the LA City Councilmember leading the way toward a $15 minimum wage and the spokesperson for the Councilmember during contentious and crucial debates about how to end homelessness in Los Angeles. David has also led campaigns, including the multimillion dollar effort to defeat Proposition 23 on the 2010 California ballot, as well as the successful underdog campaign to elect the first openly LGBT candidate to citywide office in the history of Los Angeles. Immediately prior to joining Democracy Forward, David served as the Communications Director for the Senate campaign of progressive icon, Representative Barbara Lee.

David grew up in Southern California as the child of public school teachers and union advocates and is a graduate of the University of California at Los Angeles.

Yomarilis Gueits Rodriguez is a Democracy 2025 Associate at Democracy Forward.

Before joining the organization, Yomarilis served as a Fulbright researcher at the University of Regina, where she focused on bibliographical research related to reconciliation efforts. She also gained legislative experience as an intern for the Democratic Caucus and former Minority Leader Representative Joanna McClinton at the Pennsylvania Capitol. Additionally, Yomarilis worked as a translator and interpreter in immigration and naturalization cases, as well as at local town halls, during her internship with the CLA Translation Institute at Temple University.

Yomarilis holds a dual bachelor’s degree in Political Science and Philosophy, with a minor in Women and Gender Studies, from Temple University. She plans to pursue advanced studies in the future.

Tyler is a Graphic Designer at Democracy Forward.

Prior to joining Democracy Forward, Tyler served as the Senior Graphic Designer at the Democratic Congressional Campaign Committee during the 2022 and 2024 election cycles, supporting campaigns across the country. Tyler has nearly a decade of experience designing effective and engaging content with organizations in the DC area.

Tyler earned his B.A. in Mass Communication from Towson University.

Rachel Hayden is a Senior Advisor to the President at Democracy Forward.

Rachel has more than two decades of experience supporting executives and organizations in their growth, evolution, and pursuit of excellence. She has successfully led marketing and public relations teams across a range of industries, launching luxury brands, creating national and international events, partnerships and collaborations, and other strategic projects. Her experience includes nearly two decades as Director of Public Relations and Marketing at the world-class, Michelin Three Star Inn at Little Washington. As Director of Marketing at Linder Global Events, Rachel oversaw a broad portfolio of engagements and public relations for the company and its large nonprofit and Fortune 100 clients, while also supporting the organization’s CEO in business expansion, relationship management and public appearances.

She has crafted and supported fundraising efforts to benefit numerous nonprofits including YouthAIDS, Share Our Strength, HRC, Chefs for Equality, the Washington Ballet, and World Central Kitchen.

Darcey Hayes is the Director of Finance at Democracy Forward.

She joined Democracy Forward in 2025 after more than 20 years in the for-profit sector, where she worked with large corporations such as Starbucks and Capital One, as well as emerging startups. She has extensive experience in financial planning, analytics, process improvement, and internal controls.

In 2024, Darcey transitioned to mission-driven work as a Senior Budget Advisor for the Harris-Walz campaign, where she combined her financial expertise with her passion for public service. At Democracy Forward, she oversees financial operations, ensuring efficiency and compliance to support the organization’s mission.

Darcey holds a Bachelor of Science in Political Science and is a Certified Public Accountant (CPA). She lives with her family in Richmond, VA.

Hanna Hickman is Senior Counsel at Democracy Forward.

Prior to joining Democracy Forward, Hanna was a senior enforcement attorney at the Consumer Financial Protection Bureau, where she investigated and litigated violations of the Consumer Financial Protection Act and other federal consumer financial protection laws. Prior to that, she practiced in the Public Client Practice Group at Cohen Milstein Sellers & Toll PLLC, where she represented states and municipalities in complex consumer and Medicaid fraud investigations and enforcement actions and co-chaired the firm’s Hiring & Diversity Committee. Hanna also previously practiced at an Am Law 100 law firm, and she served for a decade as an adjunct faculty member at the Georgetown University Law Center.

Hanna clerked for Judge James I. Cohn of the U.S. District Court for the Southern District of Florida. She received her J.D. from the Georgetown University Law Center and her B.A. from the University of North Carolina at Chapel Hill. She is currently studying towards an MSt in AI Ethics and Society at the University of Cambridge.

Hanna is a member of the District of Columbia and Florida (inactive) bars.

Rachel Homer is the Director of Democracy 2025 & Senior Attorney at Democracy Forward.

She joins Democracy Forward after serving most recently as the Chief of Staff of the Office of the General Counsel at the U.S. Department of Education, where she helped lead the 120-person legal office, overseeing numerous legal matters, including advising on litigation, regulatory matters, and policy issues. She previously worked as Counsel at Protect Democracy, focusing on litigating civil rights cases, especially cases challenging voter intimidation, and advising on numerous related issues involving voting rights, abuses of power, and other democracy issues. She also previously served as a litigator at the U.S. Department of Justice, Civil Division, Appellate Staff. Earlier in her career, she worked at the U.S. Department of Health and Human services implementing the Affordable Care Act.

She clerked for Chief Judge Diane P. Wood on the 7th Circuit and for Judge John D. Bates on the U.S. District Court for the District of Columbia. She graduated from Harvard Law School, where she served on the Harvard Law Review, and from Yale College. She is a member of Massachusetts and DC bars.

Jennifer Horowitz is a Research Analyst at Democracy Forward.

Prior to joining Democracy Forward, Jennifer worked as a paralegal in Cohen Milstein Sellers & Toll PLLC’s Consumer Protection practice group for over four years. While there, she worked with attorneys to achieve justice for consumers in cases against large corporations committing corporate malfeasance. She has experience working on complex multi-state class actions involving data privacy, consumer fraud, and product liability.

After graduating cum laude from William & Mary with a bachelor’s degrees in Sociology and Psychology, Jennifer spent the first year of her career working at a middle school in Washington D.C through AmeriCorps. She resides in Virginia with her girlfriend and in her free time, she enjoys playing board games, crafting, and cheering on the Washington Mystics and the Washington Spirit.

Tsuki Hoshijima is a Senior Counsel at Democracy Forward.

Before joining Democracy Forward, Tsuki was a Senior Attorney for Litigation Policy and Strategy in the U.S. Department of Justice’s Environment and Natural Resources Division. Tsuki focused on litigating high-profile appellate challenges to regulations issued by the U.S. Environmental Protection Agency, including greenhouse gas and power plant regulations. He also advised on cross-cutting legal and strategic issues.

Tsuki also served as an Attorney-Adviser in the U.S. Department of Justice’s Office of Legal Counsel, where he advised the White House and a variety of Executive Branch agencies on a wide range of legal issues.

Tsuki clerked for Judge Sandra L. Lynch on the U.S. Court of Appeals for the First Circuit and Judge Patti B. Saris on the U.S. District Court for the District of Massachusetts. Tsuki graduated magna cum laude from Harvard Law School, where he was an Executive Editor of the Harvard Law Review. He holds a B.A. magna cum laude from Yale.

Lydia Hubert-Peterson is a Research Analyst at Democracy Forward.

Before joining Democracy Forward in 2023, Lydia served as the Executive Assistant to the CEO of the National Audubon Society. In this role she supported crucial conservation efforts across the hemisphere.

Originally from the state of Minnesota, Lydia worked for U.S. Senator Amy Klobuchar in multiple capacities. Originally interning in her Minneapolis office and on her 2018 reelection campaign. In February 2021, Lydia joined the Senator’s Presidential Campaign where she traveled the country as a National Advance Organizer. After the Senator’s campaign ended, Lydia joined the Senator’s official office in D.C. where she served as a Staff Assistant and as the Senator’s Special Assistant.

Lydia received her B.A. in Political Science and Global Studies from Hamline University in St. Paul, Minnesota.

Keonnie Igwe is an Education Research Analyst at Democracy Forward.

Prior to joining Democracy Forward, Keonnie worked at Griffin & Strong, P.C. managing disparity studies and supporting other research projects on actualizing racial and gender equity in school districts, counties, and states across the country. She has also worked for the Georgia Appleseed Center for Law & Justice and the Southern Education Foundation partnering with local stakeholders and using research to advocate for educational equity for marginalized children.

After earning her B.S. in psychology at Georgia Southern University, Keonnie spent the first years of her career teaching middle and high school English in Louisiana. She resides in Atlanta where she uses her free time to write about the intersection of race, faith and politics and play tabletop Magic the Gathering.

Dominick Jacobs is an IT Specialist at Democracy Forward.

Prior to joining Democracy Forward, Dominick worked at U.S. Agency for International Development (USAID), where he provided technical support and systems administration for global development programs, ensuring reliable IT services across geographically diverse teams. Before that, he worked at Apple, delivering high-quality technical support and customer solutions in a fast-paced retail and corporate environment. In both roles, Dominick developed a reputation for exceptional problem-solving, clear communication, and a user-centered approach to technology.

Dominick attended Howard University, where he studied Computer Information Systems and developed a strong foundation in information technology, critical thinking, and communication.

Cecilia Jacobsen is Director of People, Culture, and Operations at Democracy Forward.

Cecilia joined Democracy Forward in 2023 with more than 17 years experience in the public and private sector as a people and program leader. She brings strategic and analytical thinking as well as a robust background in project management, resource allocation, and organizational development and training. Most recently, Cecilia spent 5 years with a global technology company, serving as Chief of Staff & Senior Adviser for HR Strategy to the Chief of People and Culture, developing cross-functional programs to support the employee base and achieve business objectives. Prior to her corporate experience, she worked as a civil servant in the US Government, including serving in President Barack Obama’s White House.

Corenza Jean is a Legal Analyst at Democracy Forward.

Prior to Democracy Forward, Corenza has a background in public interest law, having earned her J.D. from Howard University School of Law. Following law school, Corenza served as an Honors Attorney with the U.S. Department of Transportation. Corenza’s experience also includes clerkships with the Senate Permanent Subcommittee on Investigations and the U.S. Department of Justice Office of Professional Responsibility.

Priyanka John is a Senior Legal Assistant at Democracy Forward. Prior to joining Democracy Forward, Priyanka completed an internship with the Federal Motor Carrier Safety Administration under the Department of Transportation, where she helped to enforce federal regulations in consumer and business disputes and facilitated the revision of federal documents about consumer rights and protections. Priyanka received her B.A. in Community and Global Public Health from the University of Michigan, and hopes to pursue a J.D. sometime in the future.

Kalli Joslin is a Legal Analyst at Democracy Forward.

Before this role, she was the Steven Gey Constitutional Litigation Fellow at Americans United for Separation of Church and State, where she represented clients challenging state abortion restrictions and the approval of the nation’s first religious public charter school and submitted several amicus briefs addressing LGBTQ+ discrimination. While at Georgetown University Law Center, she served as the Editor-in-Chief of the Georgetown Journal of Gender and the Law, a student-attorney in the Civil Rights Clinic, and an intern with Lambda Legal and ACLU National. She received her B.A. with honors in American Studies and Dramaturgy from Rollins College in Winter Park, Florida. She generally spends her free time engaged in various forms of fiber art. She is a member of the D.C. Bar.

Olivia King is a Legal Assistant at Democracy Forward.

Prior to becoming a Legal Assistant, Olivia was a Data Analyst at Democracy Forward. She received her B.A. in Anthropology and Political Science from the University of Massachusetts Amherst, where she also served on the Dean’s Student Advisory Council and conducted research on Solidarity Economic Reform for the Center for Economic Democracy.

Olivia has previously interned with the American Society of Association Executives to support tax and education equity bills and has also helped manage a county-wide election for her hometown. She is currently studying for the LSAT and looks forward to pursuing futures that intersect human rights and law.”

Jessica Lee is a Legal Assistant at Democracy Forward.

Prior to joining Democracy Forward, Jessica was an associate at a government consulting firm, assisting a federal agency in the strategic implementation of diversity, equity, and inclusion initiatives. Jessica received her B.A. from Princeton University, where she majored in History and participated in student advocacy initiatives related to reproductive justice, expungement education, and drug policy reform. Jessica is incredibly passionate about the intersections of civil rights and public health, and intends on attending law school in the future.

Emma Leibowitz is a Legal Fellow, co-sponsored by Harvard Law School, at Democracy Forward.

Emma graduated cum laude from Harvard Law School in 2023. While at Harvard, Emma served as a Solicited Content Editor for the Civil Rights-Civil Liberties Law Review and was a member of the school’s chapter of People’s Parity Project. She worked as a student-attorney in the Veterans Law and Disability Benefits Clinic and as an extern in the office of Associate Attorney General Vanita Gupta at the Department of Justice. She also was a Teaching Fellow for Constitutional Law. During her summers, she worked on immigration direct services and in the Voting Section of the Civil Rights Division of the Department of Justice.

Before law school, Emma spent two years on the legal team at the Obama Foundation and a year as a paralegal at Texas RioGrande Legal Aid, where she supported women and children seeking asylum. Originally from the DC-area, Emma graduated with honors from the University of Pennsylvania with a B.A. in History.

Cynthia Liao is a Senior Counsel at Democracy Forward.

Cynthia Liao joins Democracy Forward after most recently serving as a Trial Attorney at the U.S. Department of Justice, Civil Division, Federal Programs Branch, where she litigated high-stakes challenges to federal regulations and enforcement actions in district courts across the country, including numerous cases involving structural constitutional challenges to federal agencies’ authority. Before that, she worked at the U.S. Department of Labor for 7 years, most recently as a senior counsel to the Solicitor of Labor. Her portfolio included constitutional and administrative law issues affecting DOL programs, DOL’s Supreme Court and amicus docket, and workers’ compensation, among others.

Cynthia clerked for Judge David O. Carter of the U.S. District Court for the Central District of California and Judge Michael D. Hawkins of the U.S. Court of Appeals for the Ninth Circuit. She graduated from Yale Law School and Stanford University.

Michael (Mike) Ceja Martinez is Senior Counsel at Democracy Forward.

Mike has extensive Government experience in both the career and political civil service, in addition to his litigation experience in private practice. He served most recently as the Deputy General Counsel at the U.S. Office of Personnel Management. Mike helped lead the Office of the General Counsel and provided policy leadership on dozens of regulations impacting the 2.3 million Federal civil servants in close coordination with OPM leadership, the White House, and the Office of Management and Budget. Mike was central in the administration’s efforts to protect the civil service and merit system principles from politicization. He was also selected to the President’s Leadership Workshop, a White House program to develop and deepen the management and executive experience of senior political appointees.

Immediately prior to his position at OPM, Mike served as Chief of Staff and Senior Counsel to the Assistant Attorney General at U.S. Department of Justice’s Environment and Natural Resources Division, where he assisted the Assistant Attorney General with managing the Division and its 600 employees. He worked closely with the Offices of the Attorney General, Deputy Attorney General, and Associate Attorney General on matters important to the Division, including the creation and rollout of DOJ’s inaugural Office of Environmental Justice.

Mike formerly served as a DOJ trial attorney and as a litigator at Steptoe & Johnson LLP. He clerked for the Honorable S. James Otero on the U.S. District Court for the Central District of California and the Honorable Philip R. Martinez on the U.S. District Court for the Western District of Texas. He holds a J.D. from Columbia Law School, where he was a Senior Editor on the Columbia Law Review and President of the Latino/a Law Students Association, and a Bachelor of Arts with honors from Stanford University. Mike is currently licensed to practice in Washington, D.C. and California.

Joel McElvain is Senior Legal Advisor at Democracy Forward.

Joel served until January 2025 with the Office of General Counsel of the U.S. Department of Health and Human Services. As an acting Deputy General Counsel, he was responsible for legal advice on all matters involving the Centers for Medicare and Medicaid Services, including the Medicare and Medicaid statutes and the Affordable Care Act. He also served as a Special Counsel in OGC with responsibility for coordinating legal advice concerning the Medicare Drug Price Negotiation Program established by the Inflation Reduction Act. Mr. McElvain previously served as an assistant director in the Federal Programs Branch of the Department of Justice, with responsibility for HHS litigation matters. While at the Department of Justice, he participated in the government’s defense of the Affordable Care Act in National Federation of Independent Business v. Sebelius (2012) and King v. Burwell (2015), and received the Attorney General’s Award for Exceptional Service, the Department’s highest honor.

Mr. McElvain is a magna cum laude graduate of the Harvard Law School and a magna cum laude graduate of Williams College.

Dan McGrath is Senior Oversight Counsel at Democracy Forward.

Dan most recently served as a senior counsel in the Office of the Solicitor in the U.S. Department of Labor (DOL). Dan coordinated DOL’s responses to congressional oversight requests and subpoenas, and served as front office counsel for several program and issue areas, including unemployment insurance, recent administrative law decisions, and immigration-related matters. Prior to DOL, he served as a counsel on the Select Subcommittee on the Coronavirus Crisis led by Rep. Jim Clyburn. Dan led oversight investigations of economic programs implemented to address the pandemic’s fallout and private sector actors’ conduct during the crisis. He earlier served as lead counsel for federal investigations at American Oversight, where he litigated public records cases to advance investigations of government malfeasance.

Dan started his legal career as a litigation associate at the law firm Paul, Weiss, Rifkind, Wharton & Garrison, and previously taught high school social studies at St. Francis Indian School on Rosebud Reservation in South Dakota. He received his law degree cum laude from Harvard Law School and his undergraduate degree magna cum laude from Georgetown University.

Nikki McKinney is the Policy Director at Democracy Forward.

Nikki has worked for nearly two decades on the Hill and in the Executive Branch. She joins Democracy Forward after serving four years as Associate Deputy Secretary at the U.S. Department of Labor. Before joining the Biden-Harris Administration, she was Labor Policy Director on the Senate Committee on Health, Education, Labor, and Pension for Ranking Member Patty Murray (D-WA).

She is a teacher by training, having taught high school social studies in public schools in Delaware and Virginia. Her first job after leaving the classroom was as a Legislative Assistant for Senator Susan M. Collins, where she handled Education, Labor, and Native American Affairs for the Maine Republican.

She joined the Obama Administration’s Labor Department’s Office of Congressional and Intergovernmental Affairs in 2010, eventually working her way up to Deputy Assistant Secretary.

She returned to a focus on education policy in January 2017 and joined a small DC-based nonprofit, the Alliance for Excellent Education, as Director of Policy Development and Federal Government Relations, until returning to the Hill and working on the HELP Committee in 2018.

Nikki earned a Bachelor of Arts in Political Science Education from the University of Delaware and a Master of Arts in Education Policy Studies from the George Washington University. She lives in Virginia with her daughter, Paisley.

Brooke Menschel is a Senior Counsel at Democracy Forward.

Brooke joined Democracy Forward from Brooklyn Defender Services, where she served as the Director of Civil Rights and Law Reform. In that role, she worked to address systemic deficiencies in New York City’s Department of Correction and family, immigration, and criminal courts. Prior to joining BDS, Brooke litigated state and federal trial and appellate cases concerning children’s rights, juvenile justice, the criminal legal system, and mass incarceration in the Deep South at the Southern Poverty Law Center and in New York at the local affiliate of the ACLU.

Before going to law school, Brooke worked as a policy and legislative advocate on human and civil rights issues in Washington, D.C. for the American Jewish Committee, and as communications strategist at the Anti-Defamation League in Boston.

Brooke received her J.D. from the Benjamin N. Cardozo School of Law and her B.A. from Tufts University. She is a member of the bar in Washington, D.C. and New York.

Daniel Miller is Senior Advisor for Democracy 2025 at Democracy Forward. Since joining Democracy Forward, he has helped lead efforts to expose Project 2025 and stand up Democracy 2025, the strategic hub to protect people and their rights should the Trump-Vance administration seek to unlawfully strip away freedoms and prosperity.

Daniel has a range of experience advocating for and defending democracy. He founded and organized the Society for Constitutional Protection for this purpose in New York. And immediately before joining Democracy Forward, he served as the Director of Content and Strategy at the Renew Democracy Initiative. His writings have appeared in the Washington Post, CNN, the Daily Beast, and others.

Originally from Washington, D.C., Daniel has a Bachelor of Arts in Astrophysics from Princeton University, and a J.D. from Georgetown University Law Center. After law school, he clerked for a federal judge. Daniel is a member of the New York Bar.

Kayla Minton Kaufman (she/they) is a Legal Fellow, co-sponsored by Georgetown University Law Center, at Democracy Forward.

Kayla graduated from Georgetown University Law Center in 2024, receiving the Lorri L. Jean Award for Excellence in LGBTQ Leadership & Advocacy, Associate Dean’s Award for Excellence in Clinic, and Special Pro Bono Pledge recognition. While at Georgetown, Kayla served as an Administrative Editor for the Georgetown Environmental Law Review and as Co-President for both OutLaw (LGBTQ+ Affinity Group) and Jewish Students for Justice. During her semesters, she worked as a student-attorney in Georgetown’s Appellate Litigation Clinic, a research assistant for Georgetown Climate Center and Professors Kevin Tobia and Brian Wolfman, an extern for Earthjustice and Americans United for Separation of Church and State, and a Pilates instructor at the law school’s gym. During her summers, she worked at ACLU National and the Mid-Atlantic Innocence Project.

Before law school, Kayla worked professionally in theater as a director, producer, educator, and artistic administrator, including working at American Conservatory Theater and Santa Cruz Shakespeare in California, the National Women’s Theater Festival in North Carolina, and Portland Stage Company in Maine. Originally from California, Kayla graduated from Loyola Marymount University with B.A.s in both Theater Arts and Film and Television Production. She remains an enjoyer of many artistic hobbies as well as a nature enthusiast.

Gracia Mirindi is a People and Culture Associate at Democracy Forward.

Prior to joining Democracy Forward, Gracia was a Legal Assistant at Fellow LaBriola, LLP, in Atlanta GA where she assisted attorneys and legal staff members in criminal cases, civil litigation, and insurance recovery. She also worked as an Underwriting Assistant for Beazley Group in Atlanta GA.

Gracia received her B.A. in Political Science with a concentration in Pre-Law from Georgia State University. She also received her M.S. in Criminal Justice concentrating in Law and Public Policy from Walden University.

Khira Mistry is the Director of Scheduling and Executive Assistant to the President and CEO.

Khira served as a political appointee for the Biden-Harris Administration, working as Special Assistant and Paralegal to Deputy Attorney General Lisa Monaco. Khira addressed a wide range of issues including immigration, national security, gun reform, and reproductive health access.

Prior to working at the Department of Justice, Khira gained invaluable experience in the nonprofit sector, including roles at Reproductive Freedom For All and Protect Our Defenders, where she supported legislative advocacy efforts and campaign work aimed at advancing reproductive rights and sexual assault protections in the military. Khira received her B.A. in Political Science and History from California State University, Fullerton.

Sterling Moore is Counsel at Democracy Forward.

Sterling comes to Democracy Forward with a background in law, having received his J.D. from the University of Virginia School of Law. There, he served on the Virginia Law Review and graduated Order of the Coif. Following law school, he worked as a litigator in private practice and clerked for the Honorable Andrew J. Kleinfeld of the United States Court of Appeals for the Ninth Circuit.

Originally from Texas, Sterling holds a B.B.A. in Economics and Business Fellows from Baylor University. Before attending law school, he served as a scholarship program coordinator at a community nonprofit in Waco, TX.

Sterling is a member of the District of Columbia and Texas Bars.

Jodie Morse is the Chief Program and Strategy Officer at Democracy Forward.

Jodie is a litigator and strategic advisor with experience in all three branches of government, private practice, and the non-profit world. She most recently served as Deputy Associate Attorney General at the Department of Justice, where she helped to oversee the Civil Division, the Office of Information Policy, and the Tax Division and also served as the Executive Director of the Reproductive Rights Task Force, where she lead day-to-day the Department’s work to safeguard reproductive freedoms under federal law following the Dobbs decision.

Immediately prior to the Department of Justice, Jodie worked at the White House and the Office of Management and Budget. A founding member of the Democracy Forward litigation team, Jodie also previously served as Deputy General Counsel in the Office of General Counsel in the U.S. House of Representatives and worked at the U.S. Securities and Exchange Commission and at a global law firm.

Jodie received her J.D. magna cum laude from New York University School of Law and her B.A. magna cum laude from Yale University and served as a law clerk for Judge Harry T. Edwards of the U.S. Court of Appeals for the D.C. Circuit and Judge Raymond J. Dearie of the Eastern District of New York.

Jessica Morton is Senior Counsel at Democracy Forward, where she has represented non-profits and individuals in both litigation and regulatory advocacy. Her work has included challenges to abuses of executive power at the state level, advocacy for federal criminal legal system reform, environmental justice, and other issues.

Before joining Democracy Forward, she was a litigator at Paul, Weiss, Rifkind, Wharton & Garrison LLP, where she practiced complex civil litigation at all three levels of the federal court system. Jessica also maintained a significant pro bono practice focused on voting rights, civil rights, and criminal justice. She has been honored as a co-recipient of the Young Lawyer of the Year Award from the Young Lawyers Section of the Bar Association of the District of Columbia. Jessica has also served as an adjunct professor at Georgetown University Law Center.